I recently thought about applying for a travel credit card as I am going to travel a lot more than I usually have done in the past. Thought it is the right time to apply for one. And while I was doing my search online for the credit card, I found a couple of options that are great for first timers, just like myself.

So, if you are someone who has some pre-planned travels for next year, read my guide below for some of the best foreign usage and fee-free travel credit cards.

Barclaycard Rewards

The Barclaycard Rewards has a representative APR of 22.9% with no fee on purchases abroad. You would also get 0.25% cashback on all your spending.

As long as you pay in the local currency of your travel country, you can avoid the non-sterling purchase fees. You’ll be able to withdraw cash from an ATM without any charges. You won’t be charged interest on cash withdrawals made abroad, given if you pay off your balance in full each month.

The Barclaycard rewards provides protection on purchases over £100 and up to £30,000. You can get up to £1,200 of credit limit, whereas late payment is charged at £12, over credit limit is charged at £12 and returned payment is charged at £0.

Get more information on the card at Barclays.

Read more: How to save money for travel?

Santander Zero

The Santander Zero Credit Card has a representative APR of 18.9% again with fee-free spending and cash withdrawals worldwide.

The Santander Zero offers 0% interest on purchases for 12 months from the date of opening the account. (just remember interest on cash withdrawals is charged as soon as you take the money out).

You can also benefit from the offer of up to 15% cashback at selected retailers with the Santander Zero credit card.

The credit limit for the credit card is £1,200 whereas the late payment fee is £12, over credit limit fee is £12 and returned payment fee is £12.

Get more information on the card on Santander.

Halifax Clarity Mastercard

The Halifax Clarity Credit Card has a representative APR of 27.9% and just like the other recommended cards, won’t charge you for purchases worldwide, but you will be charged interest from the date the withdrawal is made. So, it is highly recommended you should not use this card at an ATM, if possible.

This card provides one-rate for everything and it is a no annual fee card.

The Clarity card provides protection on purchases made at home and abroad for over £100 and up to £30,000.

The credit limit of with this card is £1,200, where fee is applied for late payment, over credit limit and returned payment.

Get more information on the card at Halifax.

I personally have an account with Barclays so I am going to apply for the Barclays Rewards Card.

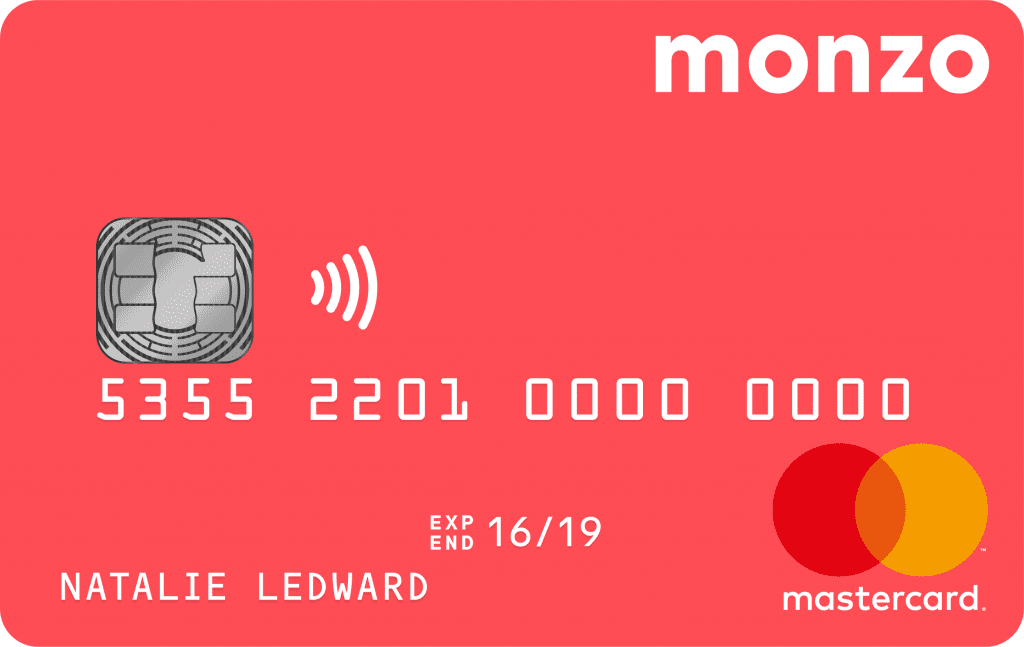

Monzo

While the above are the best options for anyone who is looking for their first travel credit card, another option to consider is Monzo. Monzo is an online bank and it is the best option for opening a UK bank account for someone who doesn’t have a proof of address to provide. You will need to operate the bank account via the Monzo app – it’s available on both iOS and Android. I myself have a Monzo account and used it on my last two vacations and it is so easy to use.

With Monzo’s current account, there is no fee charged for the transactions made abroad. ATM withdrawals with Monzo are free in UK and most of the Europe. Cash withdrawals of up to £200 in any 30-day period (3% fee above) are fee-free.

Why you should use a credit card for spending abroad?

You can choose to pay for purchases made abroad with your debit card but instead a huge benefit of using a credit card is that you’re covered if there are any problems with purchases you make over £100.

With credit card, you can claim compensation either from the merchant or your credit card provider, under Section 75 of the Consumer Credit Act. As you can see the benefits of the travel credit cards mentioned above, you can earn cashback on your purchases, both in the UK and abroad. Make sure you always make payments in local currency.

If you know any other travel credit cards for the first timers, do share it in the comments below. XX

No Comments